We do what we said we will do, and rigor, curiosity, and a growth mindset are part of who we are.

Our investment strategy was developed to maximize our long-term potential upside while limiting the risk of permanent capital loss.

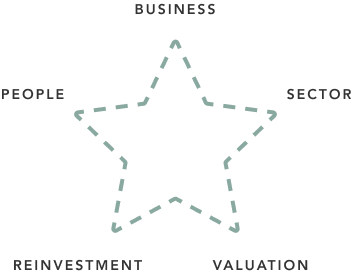

To consistently execute our strategy, we have built a documented and proprietary bottom-up investment approach which relies on our investment framework’s North Star, based on five fundamental elements.

Ultimately, our investment strategy results in a high-conviction portfolio of 12-15 long-term holdings, on which we are highly knowledgeable and stay close to during the whole ownership period.

“Investment is most intelligent when it is most business-like” – Benjamin Graham

Idea generation is where it all starts. Our overall attitude in terms of idea generation is to stay curious and not discriminate against the source of the ideas. At this initial stage, our process is based on a certain level of guided serendipity. We aim to eliminate new ideas fast, avoid hot stocks, and keep our trigger-ready list up to date.

Our research process is aligned with our long-term focus and is therefore highly demanding. We try to understand the opportunity for the next decade, which implies focusing on evaluating fundamental elements that will make a difference in the long run. We also aim to stay aware of and reduce our biases as much as possible.